Factoring is a unique product that helps to solve many financial problems, promote and strengthen your position in the market.

Factoring by JSC "COMINBANK" is a comprehensive service for your business, including:

- Prompt decision-making on financing without collateral and a basic package of documents.

- Financing under the assignment of the right of monetary claim.

- Administrative management of receivables.

- Consultations.

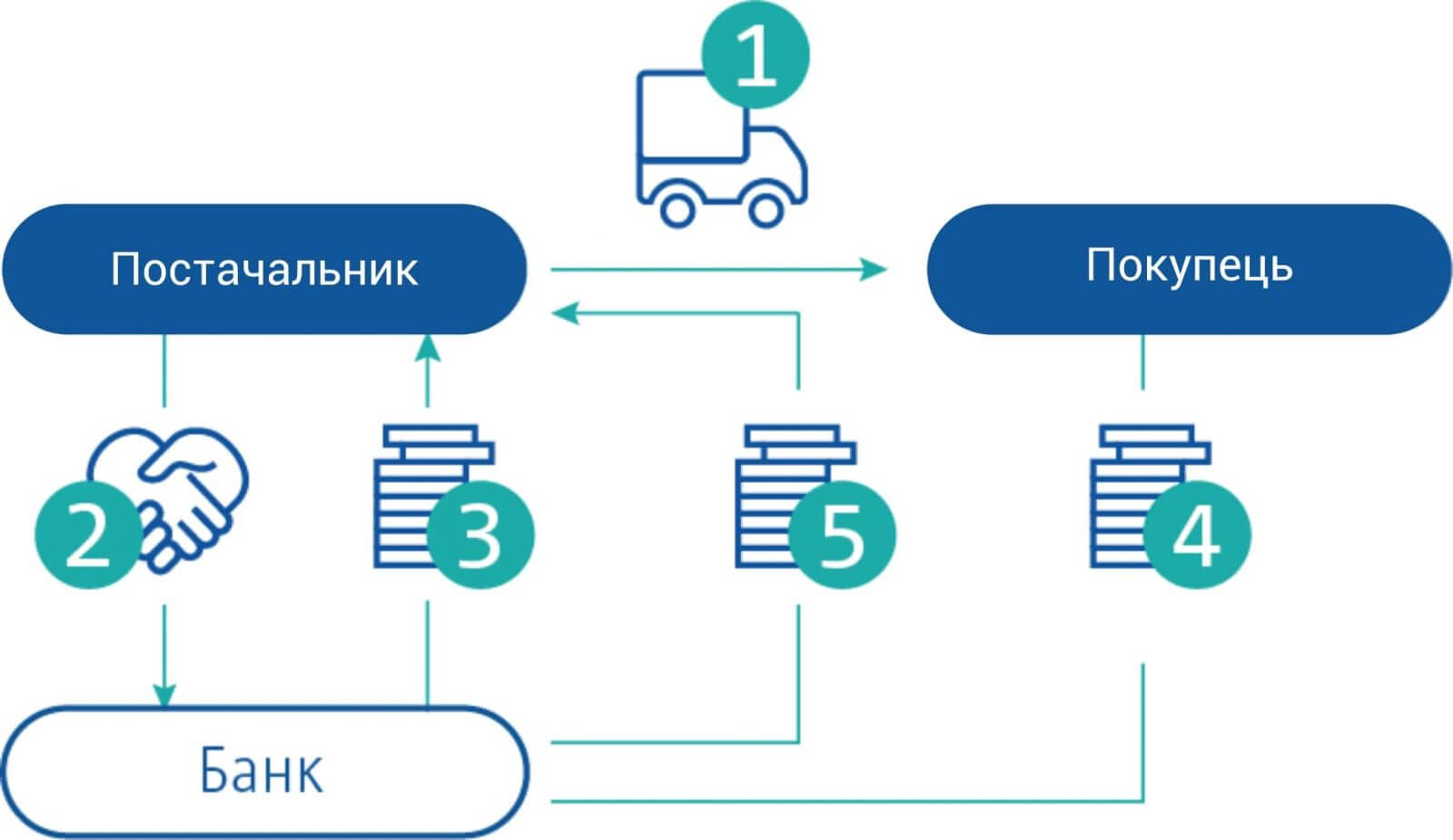

FACTORING SCHEME

- Supply of goods on deferred payment terms.

- Assignment of the right to claim the debt for the supply to the Bank.

- Providing the Bank with the original documents confirming the emergence of the rights of claim.

- Payment of the initial payment (up to 80% of the claim amount).

- Payment by the Buyer for the delivered goods (performed works, rendered services) to the Bank.

- Payment of the final instalment.

Advantages of factoring for the Supplier (Customer):

- the possibility of financing working capital without collateral;

- conversion of receivables into real money;

- possibility to buy foreign currency by means of factoring financing

- elimination of cash gaps;

- acceleration of cash flow;

- the possibility of providing Buyers with more favourable payment terms;

- increasing the number of potential Buyers;

- significant increase in sales volumes;

- improvement of the Buyers' payment discipline;

- reduction of risks associated with delayed payments;

Advantages of factoring for Buyers:

- receipt of goods/works/services from the Supplier with deferred payment (trade credit);

- increase in procurement volumes without raising additional capital.

The Supplier (Customer) shall meet the following requirements:

- have at least one year of experience;

- carry out regular deliveries of products/performance of works/services on a deferred payment basis;

- work with regular Buyers;

- have a satisfactory financial condition.

PRODUCTS

Open factoring with recourse*. In this case, the debtor is notified in writing that the Factor is involved in the transaction and the debtor must send payments under the Contract to the Factor's account.

*Recourse means the right of the bank to return unpaid supplies to the company. In case of non-payment by the debtor, the Customer, after the end of the Waiting Period, undertakes to repay the Bank the funds received from the debtor.

Closed factoring with recourse. When the debtor does not notify the Bank of the factoring agreement and continues to make payments to the Customer. In this case, a separate account is opened for the Customer for the purposes of factoring services, to which payments under the Contact are directed. Such account shall be specified in the Product Supply Contract.

RATES (basic conditions)

- The financing fee is charged as an annual percentage on the balance of the factoring financing. It is set at the level of 17% per annum depending on the deferred payment under the Contract.

- The commission for the provision of financing is charged on the balance of the financing (from 0.4% of the financing amount).

- Receivables administration fee is charged depending on the face value of the invoice (0.1% of the face value).

Contact information:

For more information, please contact the Factoring, Documentary and Trade Finance Department, tel. 0 800 501 200 (ext. 3525), factoring@cib.com.ua.

| Viber | Telegram |

|

|