- USD 43 / 43.29 НБУ: 43.2081

- EUR 50.9 / 51.33 НБУ: 51.0244

1. a convenient way to pay for purchases in retail and service networks and the Internet, including payments abroad;

2. Round-the-clock access to your accounts and transactions with them in the internet banking "CIB-online";

3. the ability to receive cash both in Ukraine and abroad at a convenient time for you;

4. credit limit or accrual of interest on the balance in UAH;

5. access to offers, discounts and promotions under «the "Mastercard more" bonus program»;

Get additional benefits by choosing a premium Platinum Card from JSC COMINBANK:

1. additional privileges and exclusive offers from Mastercard;

2. access to services at Ukrainian airports: Mastercard and Fast Line business halls;

3. credit limit in the amount of up to 150 thousand UAH;

4. 7% per annum on the balance in UAH (by choosing the TP PLATINUM+ Payment Card);

5. free additional MC World Debit Cards.

Possible consequences when using a card account

The bank does not have the right to make changes to agreements concluded with clients unilaterally, unless otherwise established by the agreement or law. The bank has the right to make changes to the tariffs or rules for servicing individuals in JSC "COMINBANK". In this case, the notice of amendments shall be posted on information stands located in the bank's premises and/or on the official website of the Bank

The Bank is prohibited from requiring the client to purchase any goods or services from the Bank or a related or affiliated person as a prerequisite for the provision of these services (except for the provision of a package of banking services).

The client has the right to refuse to receive advertising materials by means of remote communication channels by sending an appeal through the bank's official website

In order to protect funds, to prevent and counteract crimes with payment cards, it is necessary to keep your PIN secret from other persons, do not write down the pin on the card or on other items stored with the card. In the event of loss/theft of the Card, if the PIN has become known to third parties or if fraudulent actions with the Card have been detected, the Cardholder must immediately notify the Bank by calling the Contact Center to block the Card. The Cardholder has no right to transfer the Card for use to other persons and disclose the Card details. Using the Card for payments on the Internet carries an increased risk. The Card shall be used in trade (service) enterprises and at bank cash desks in the presence of the Cardholder.

If the tariff package provides for the accrual of interest on the positive balance of funds on the Current Account using a payment card, the accrued interest shall be taxable in accordance with the requirements of the Tax Code of Ukraine.

Passport of

citizen of Ukraine

Taxpayer

Identification Number

Transliteration of first and last names (similar to passport data)

For a child's card - documents of the child (under the age of 14 - a birth certificate; over the age of 14 (inclusive) - ID card with an identification code

Pay with a Mastercard payment card from JSC "COMINBANK", accumulate points and exchange them for interesting offers and participate in promotions under the Mastercard more bonus program.

To participate in the program, you must register here.

You can set a PIN code for a new card as follows:

- Call the Contact center by phone 0 800 501 200;

- Pass identification by the Contact center operator;

- Inform about your desire to get a PIN code;

- Get an SMS message with a PIN code to your financial phone number.

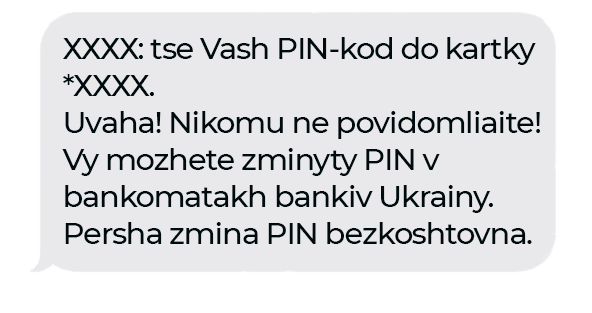

The PIN code will be sent to you in an SMS message with the following content:

Enabling SMS banking to receive a PIN code is optional.

It is mandatory to have the client's financial phone number in the Bank.

You can change the PIN code at an ATM or through the Contact Center. To set a new PIN code at the ATM, you must remember your old PIN code.

The option of re-obtaining a PIN through the Contact Center is available for cards issued after 09/16/2021.

You can change the PIN code to the card via the Contact Center as follows:

- Call 0 800 501 200;

- Pass identification by the Contact center operator;

- Inform about your desire to get a PIN code;

- Get an SMS message with a PIN code to your financial phone number.

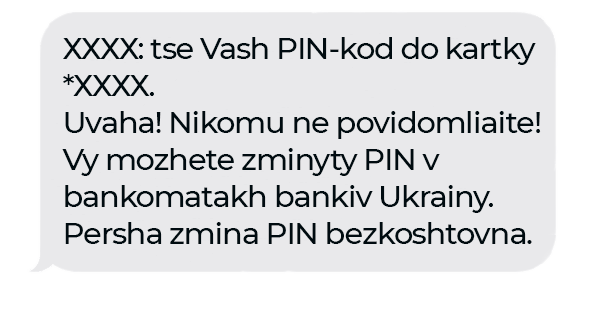

The PIN code will be sent to you in an SMS message with the following content:

Enabling SMS banking to receive a PIN code is optional.

It is mandatory to have the client's financial phone number in the Bank.

If your card was issued before 16.09.2021 and you forgot your PIN code, you need to contact the bank outlet and reissue the card. In the future, you will be able to get a PIN code in a text message.

You can change the PIN code at ATMs of the following banks:

• "CB "PRIVATBANK" JSC;

• RAIFFEISEN BANK JSC;

• "UKRGASBANK" JSB;

• OTP BANK JSC;

• "KREDOBANK" JSC;

• "FUIB" JSC;

• PIVDENNY JSC

• CREDIT AGRICOLE BANK JSC;

• "BANK VOSTOK" PJSC.

To set a new PIN code at the ATM, you must remember your old PIN code.

*The list is not exhaustive.

You can get the card by contacting one of the following Bank outlets. You must provide your passport and identification code there. Please note that when applying for a children's card or credit card with a limit of more than 10 000 UAH, you must provide additional documents. It takes about 15 minutes to issue a non-personalized card (instant card). Arrange a convenient time for visiting the bank outlet with our manager by leaving a request.

• via a chatbot (section "my cards" – "card limits");

• call the Contact Center at: 0 800 501 200 (calls are free within Ukraine) or +38 (044) 290-79-00 (the cost of calls is charged according to the tariffs of your mobile operator). Limits are valid for up to 30 calendar days;

• contact the nearest bank branch (you must have a passport or other identity document with you).

• * call the Contact Center at: 0 800 501 200 (calls are free within Ukraine) or +38 (044) 290-79-00 (the cost of calls is charged according to the tariffs of your mobile operator). Limits are valid for up to 30 calendar days;

• * via a chatbot (section "my cards" – "card limits");

• contact the nearest bank branch . You must have a passport or other identity document with you.

• through the cash desk (crediting in foreign currency can be made only by the account holder or by an authorized representative under a power of attorney)

• via an ATM of another bank with the function of accepting cash

• via a self-service terminal.

• from an account opened with JSC "COMINBANK – in the internet banking system "CIB-online"

• transfer from card to card

• transfer from another bank using your bank details.

If you lose your card immediately block it using one of the following methods:

• call the Contact Center at: 0 800 501 200 (calls are free within Ukraine) or +38 (044) 290-79-00 (the cost of calls is charged according to the tariffs of your mobile operator).

• in the CIB-online Internet banking system (go to the section "Payment Cards" - "Card Management" and select "Block Card").

• via a chatbot (section "My cards" – "Card blocking").

Maximum limit for cash withdrawals at the cash desk at the following retail outlets*:

* The list is not exhaustive. Retail outlets where cash is issued have the right to independently determine the amount of funds issued.

Before paying, you need to warn the cashier about your desire to withdraw cash.

If your tariff package does not provide for a fee for withdrawing funds from an ATM of another bank, but a warning appears when you withdraw funds - this is the acquiring bank's fee, JSC COMINBANK does not affect its withholding, you have the right to perform the operation with an additional fee or refuse to perform it. You can refuse the transaction and receive funds at the cash desk of JSC COMINBANK or withdraw funds at the cash desk when making purchases in retail and service networks without commissions.