• Special privileges and exclusive offers from Ukrainian and global companies - the indisputable leaders in the service and tourism sector (under the Priceless Privileges programme);

• Offers and discounts from partners, promotions and invaluable gifts (under the «Mastercard Bilshe» bonus programme)

Additional benefits for Mastercard Platinum cards:

• Exceptional privileges from partners in Ukraine and abroad ( under the "Priceless Privileges" programme)

• Access to special offers ( under the "Mastercard Bilshe" bonus programme);

• Access to services at Ukrainian airports*:

• Mastercard business lounges in the international departures area at Boryspil Airport (Terminal D);

• Fast Line in the international departures area at Boryspil (Terminal D) and Kyiv (Zhuliany) airports (Terminal A).

*The service is provided free of charge 2 times a month (services to choose from) in accordance with the current Fares.

Terms of service at Ukrainian airports:

1. you must have an active card with a balance of at least UAH 1;

2. to enter the correct PIN code (except for the Fast Line service for departure);

3. the name on the card and the boarding pass must match (except for the Fast Line service);

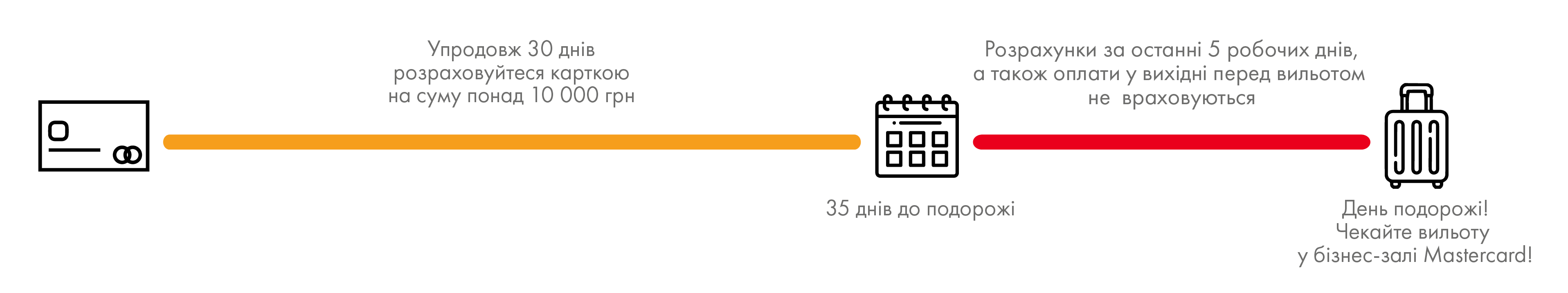

4. transactions on the card totalling at least UAH 6,000 (from 01.12.2021 - at least UAH 10,000) for the last 30 + 5 days before the trip (the last 5 days and the weekend before departure are not taken into account)**.

If your card was issued less than a month ago, don't worry about the amount of transactions - you can use the business lounges without additional conditions. After the card is issued, the Welcome period is available for 37 days. To use Mastercard services at Kyiv airports during this period, you need to have an active card with a balance of at least UAH 1 and enter the correct PIN.

**Exceptional transactions that are not taken into account at all:

• cash withdrawals from ATMs or bank cash desks;

• transfer of the balance of funds;

• purchases by cheque;

• insurance premiums;

• interest;

• any fees and charges;

• traveller's cheques;

• gambling of any kind (including payments for the opportunity to win a prize);

• any cash purchases.

Transactions that count and reduce the total amount: purchases that are subsequently refunded or reimbursed.

More information on the Mastercard website