- USD 43 / 43.29 НБУ: 43.2081

- EUR 50.9 / 51.33 НБУ: 51.0244

Fill in all fields of the online loan application and wait for a response from a microcredit specialist

We will be happy to answer all your questions regarding the proposed service in any way convenient for you.

In addition to online ordering, you can visit our branches or call the Contact Center:

0 800 501 200 (free of charge in Ukraine)

|

For whom |

the business has been operating for 12 months |

|

Loan amount |

from 100 thousand to 5 million hryvnias |

|

Term |

up to 5 years |

|

Interest rate |

14% per annum on the balance |

|

Minimum collateral requirements |

property valuation is carried out at the expense of the Bank regardless of the loan amount |

|

No expenses until the Bank's decision |

loan up to UAH 1 million without insurance and notarization |

|

Convenient repayment schedule |

possibility to defer repayment for up to 6 months depending on the seasonality of the business |

|

General Loan Agreement |

work within the credit limit for the entire term of the agreement at no additional cost |

Read more:

• Passport and identification number of the Client and Guarantor

• Registration documents for the Client's business

• Title documents for the collateral

The Bank analyzes the client's business documents as of the date of the loan application. The real solvency of the client is taken into account, given all income for the previous period

The loan can be secured by real estate (residential or commercial), equipment (industrial, commercial or manufacturing), vehicles (personal or commercial). The owner of the property can be the Client or any third party.

Can the client pledge the property purchased on credit? In this case, the client can make a down payment in the amount of 20-30% of their own funds or provide additional property.

The loan is issued in UAH without reference to the exchange rate

The bank analyzes the client's credit history, but makes decisions individually in each case. Minor delays in the past are not a problem for cooperation

For the duration of the loan, the original documents for collateral property remain with the Bank, but can be provided to the client at his request, if necessary.

With a secured loan, the Bank's clients can use their real estate without any restrictions. The property remains in the client's ownership

Early repayment without penalties and commissions

Under our agreements, we cannot unilaterally change the interest rate on the loan and other terms of the Loan Agreement

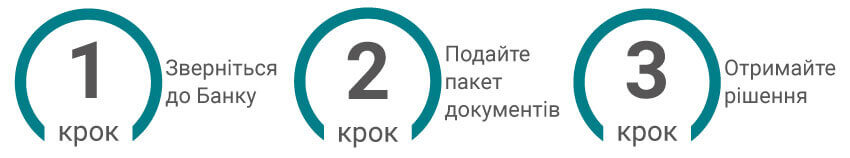

The Bank considers the client's request free of charge and provides a decision on the possibility of lending to the client within 3 days